De.Fi

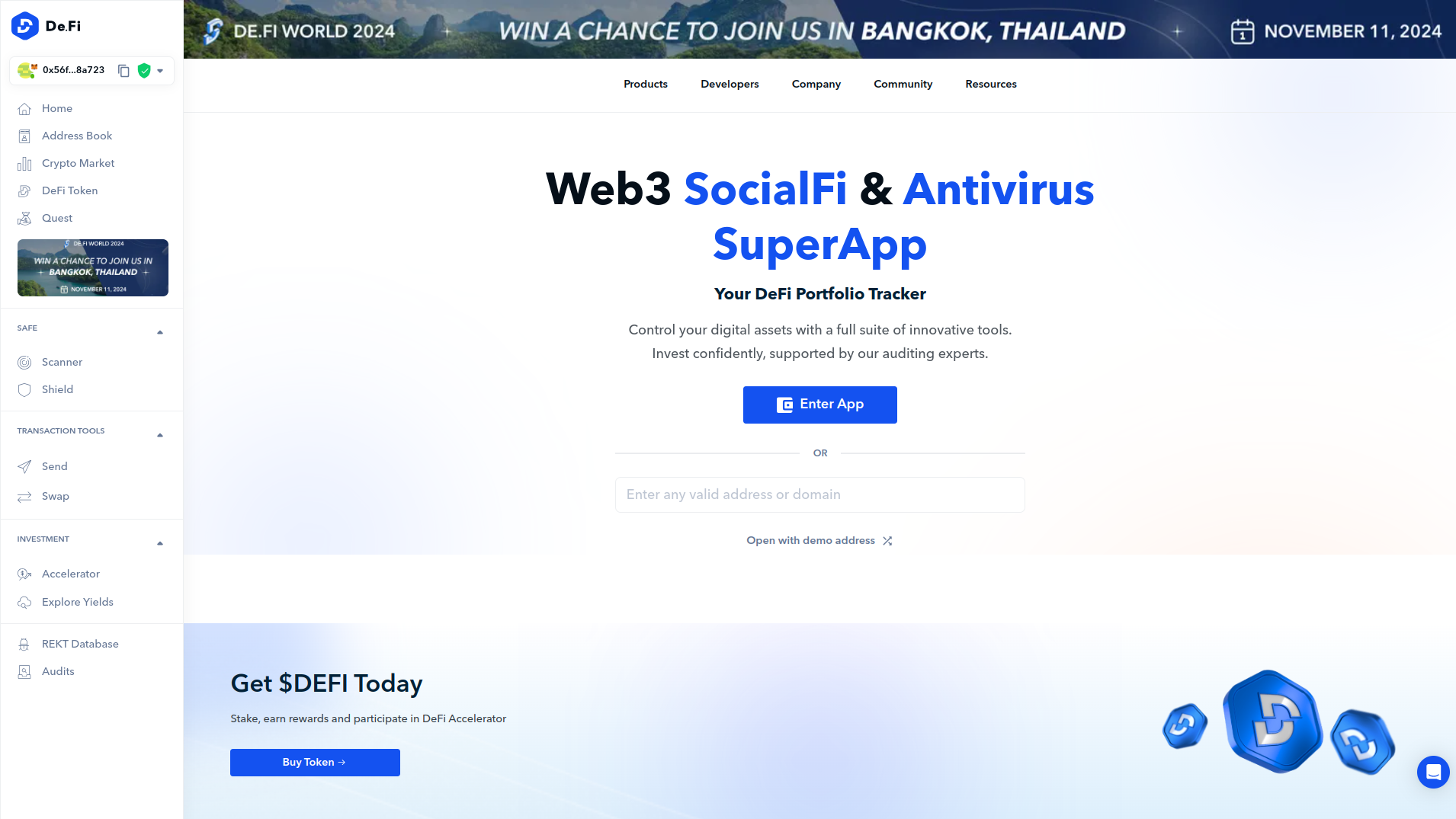

Web3 SocialFi & Antivirus SuperApp

De.Fi strives to bring DeFi to all, ensuring anyone can make the most out of the Web3 financial revolution, while investing confidently without the fear of getting rekt. By becoming essentially the Robinhood of DeFi, we can become bigger and better than our Web2 counterparts, due to no nationalized financial restrictions or adherence to legacy technologies.

Visit Website

Features

Key capabilities and services

AI-Driven Payment Infrastructure as a Service

Transactracer’s Payment Infrastructure as a Service with AI is designed to make financial transactions smoother and more secure. Whether you’re dealing with cryptocurrency or traditional fiat, this feature ensures that payments are processed seamlessly. It eliminates the hassle of slow and cumbersome transactions, offering users a fast and secure payment experience.

Secure Wallet & AI-Escrow Services

Digital assets need top-tier security, and that’s exactly what Transactracer’s Wallet and Escrow Service with AI provides. Leveraging advanced artificial intelligence technology, this feature ensures the security and efficiency of your digital assets. Your investments are safeguarded from potential threats and you can store, send, and receive funds with absolute peace of mind.

Wallet Management Across Chains

Digital assets are often scattered across multiple platforms and chains, making management a logistical nightmare. Transactracer simplifies this with Wallet Management Across Chains. Users can efficiently manage their DEX (Decentralized Exchange) and CEX (Centralized Exchange) wallets data across different exchanges and blockchains, ensuring that all their assets are easily accessible and well-organized.

Integrated AI for Business Transactions

Business transactions often involve complexities and potential errors. Transactracer’s Integrated AI for Business Transactions streamlines these processes. Whether you’re dealing in cryptocurrency or fiat, this feature simplifies and optimizes your transactions, making them more efficient and error-free.

Automated Salary Payments

Payroll processing can be a headache for businesses, with the potential for errors and delays. Transactracer eliminates this burden with Automated Salary Payments. This feature automates the entire payroll process, ensuring that employees receive their payments accurately and on time, every time.

Invoice Generation and Payment

Generating and processing invoices manually is time-consuming and prone to errors. Transactracer’s Invoice Generation and Payment feature automates the entire process, significantly reducing administrative overhead for businesses. Say goodbye to the hassles of manual invoicing and hello to streamlined financial record-keeping.

Use Cases

Implementation Areas & Usage

Cross-Border Payments

Cross-border payments have long been fraught with high fees, slow processing times, and security concerns. Transactracer is changing that by providing a cost-effective and secure solution for international money transfers.

Digital Asset Management

With the Transactracer Wallet and Escrow Service, users can securely manage their digital assets. Our advanced security features provide peace of mind, safeguarding your investments from potential threats. Rest easy knowing that your valuable digital assets are protected by cutting-edge technology.

Payroll Processing

Ensuring that employees are paid accurately and on time is a perennial challenge for businesses. Transactracer simplifies this process by automating salary payments. Companies can eliminate the manual payroll headache, freeing up resources and ensuring that their employees receive accurate and timely payments.

Enterprise Solutions Integration

Transactracer offers tailored enterprise solutions with Software Development Kits (SDKs), making it easy for businesses to seamlessly integrate its features and AI-driven capabilities. Efficiency and security are enhanced, and businesses can embrace the future of finance without the usual integration headaches.